U.S. TARIFFS: WHY IMPORTS ARE UP DESPITE NEW DUTIES

President Trump is once again threatening high tariffs on imports, now set to take effect Aug. 1, creating ongoing uncertainty for U.S. businesses and consumers.

Current Tariffs

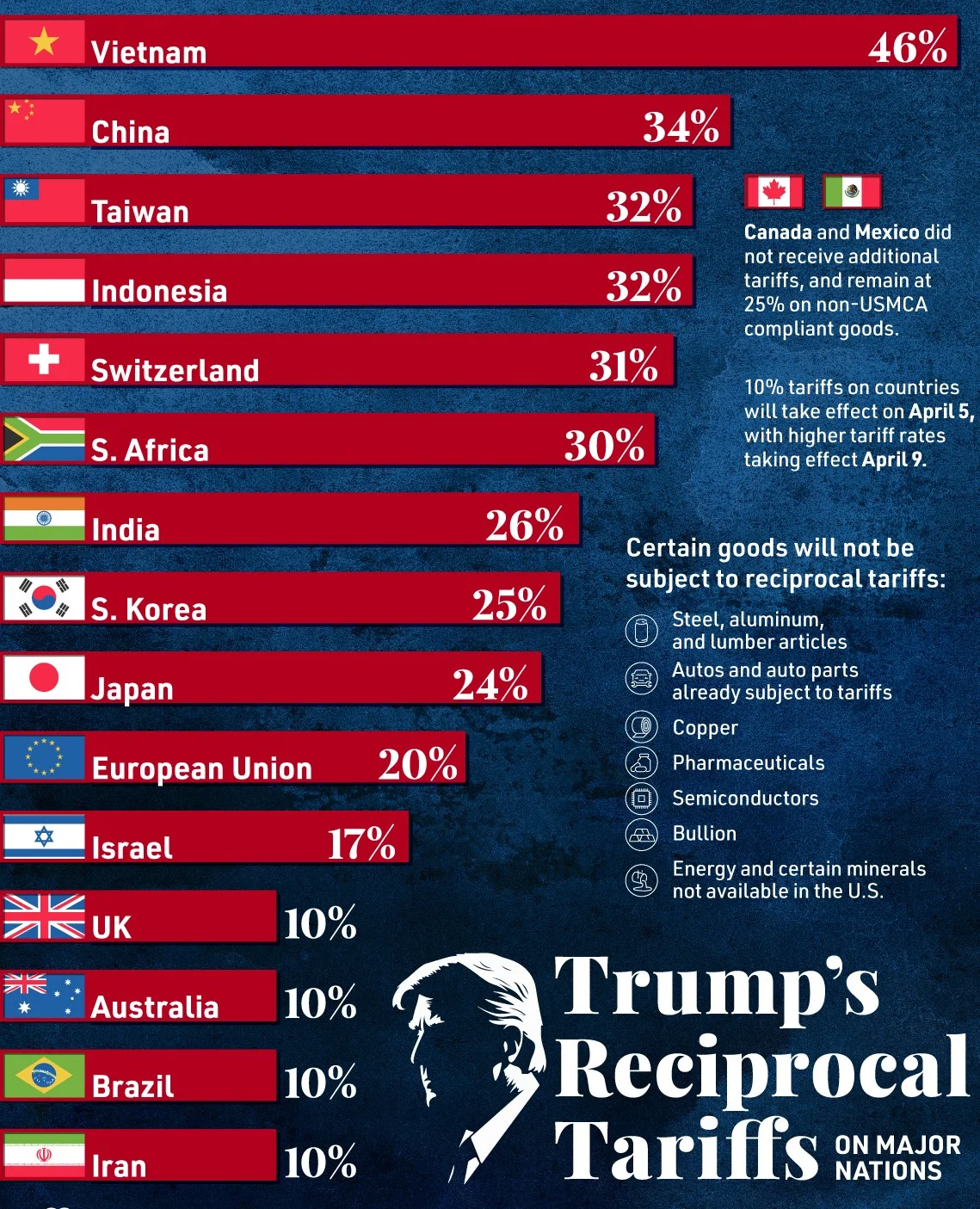

- A 10% baseline tariff applies to nearly all imports, with China facing 30%.

- Additional tariffs target steel and aluminum (50%) and autos (25%), with some exceptions under the USMCA trade deal.

- Goods from Japan, South Korea, Libya, Iraq, Brazil, and the EU may see rates from 25% to 50%, though implementation is delayed.

Special Cases

- China faces the highest tariffs due to trade imbalances and concerns over fentanyl.

- Mexico and Canada have partial exemptions under USMCA, though Trump has threatened increases on non-covered goods.

- The U.K. and Vietnam have trade deals limiting tariffs to 10–20%.

Economic Impact

- Treasury revenue from tariffs hit $27B in June, four times last year’s total.

- Uncertainty is affecting manufacturing and capital purchases, according to the Institute for Supply Management.

Legal Challenges

- Many tariffs rely on the 1977 IEEPA statute. Several lawsuits have challenged their legality, with a federal trade court striking them down but leaving them in effect during appeals.

- Trump is also considering tariffs on copper, pharmaceuticals, semiconductors, and lumber, signaling that trade tensions may continue to disrupt global commerce.